Combined entity, Ascott Residence Trust, to cement position as the largest hospitality trust in Asia Pacific.

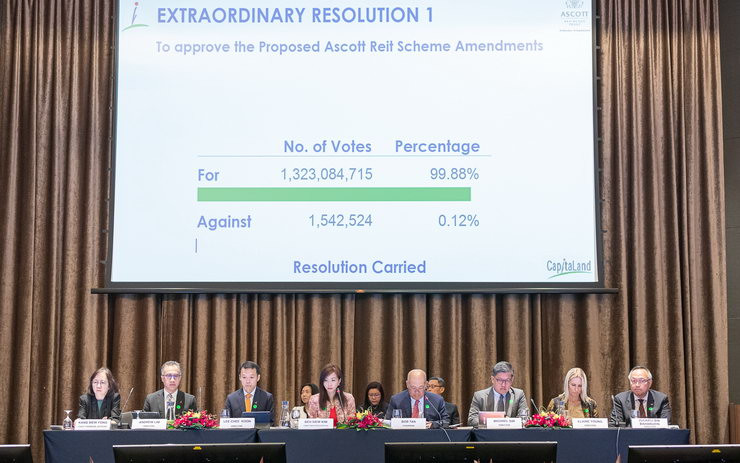

Singapore – The proposed combination of Ascott Residence Trust (Ascott Reit) and Ascendas Hospitality Trust (A-HTRUST) received strong approval of over 99% of the total number of votes from unitholders at their respective Extraordinary General Meetings (EGMs) and Scheme Meetings held at Raffles City Convention Centre Singapore. More than 1,500 unitholders and proxies attended the EGMs and Scheme Meetings, where Ms Beh Siew Kim, Chief Executive Officer of Ascott Residence Trust Management Limited (ARTML), and Mr Tan Juay Hiang, Chief Executive Officer of the A-HTRUST Managers, shared the merits and strategies of the combined entity as well as addressed questions from unitholders. The combined entity, which will continue to be named Ascott Residence Trust, will have a quality portfolio of 88 properties with more than 16,000 units across 39 cities in 15 countries.

Interested parties of Ascott Reit and A-HTRUST, including CapitaLand entities, were required to abstain from voting on certain resolutions. The proposed combination was subject to the approval by more than 50% (or 75% for certain resolutions) of the total number of votes cast by the unitholders of Ascott Reit and A-HTRUST present and voting at the respective EGMs. It was also subject to the approval by a majority in number of unitholders representing at least 75% in value of the units held by these unitholders present and voting at the respective Scheme Meetings.

All six resolutions, which were put to the vote of unitholders at the Ascott Reit EGM and Scheme Meeting, were duly passed. For the five resolutions that were related to the proposed combination of Ascott Reit and A-HTRUST, each received a resounding approval of more than 99% of the total number of votes. Meanwhile, the two resolutions pertaining to the proposed combination of Ascott Reit and A-HTRUST presented at the A-HTRUST EGM and Scheme Meeting also obtained strong support from its unitholders with each resolution receiving a strong approval of over 99% of the votes cast.

Ms Beh Siew Kim, ARTML’s Chief Executive Officer, said: “We would like to thank our unitholders for their strong support of this transformational transaction. The combination of Ascott Residence Trust and Ascendas Hospitality Trust will cement the combined entity’s position as the largest hospitality trust in Asia Pacific with an asset value of S$7.6 billion. The combined entity, Ascott Residence Trust, will be CapitaLand’s sole hospitality trust with a larger, well-diversified portfolio, and a mandate to invest in lodging assets globally. With our S$1 billion debt headroom, we will have greater financial flexibility to seek accretive acquisitions and value enhancements. We remain committed to generating stable returns to unitholders and look forward to further grow our portfolio as a combined entity.”

Mr Tan Juay Hiang, A-HTRUST Managers’ Chief Executive Officer, said: “As we mark this new milestone, we would like to thank our unitholders for their support of Ascendas Hospitality Trust and their confidence in the future growth of the combined entity. Unitholders would stand to benefit from the enhanced scale and geographically diversified portfolio of the combined entity, Ascott Residence Trust, as well as the backing of a strong sponsor in The Ascott Limited, CapitaLand’s lodging unit. Fuelled by bigger funding capacity, unitholders can look forward to participating in a hospitality trust that would fulfil our aspirations for greater growth.”

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.